Here is our collection of Free Salary Slip Templates to help you create your own slip. People are employed every day in both the public (government) and private sectors. There are millions and billions of jobs from banking, labor, writers, teachers, and whatnot. The employees of all the earlier stated and not stated fields are paid. The pay of employees is usually on weekly basis, but in most cases all over the world, employees are paid monthly. It is the responsibility of the employer (either government or private businessman or company) to pay their employees on time and keep a check of the financial records. The second part of the above statement is however the responsibility of both the employer and the employee.

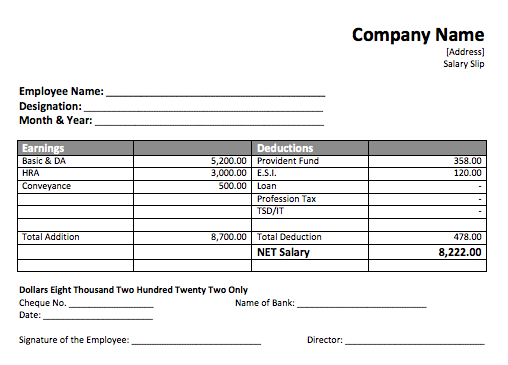

In this Salary Slip Template, you can notice that it provides ample space for mentioning critical salary particulars such as Provident Fund, Traveling Allowance, Loan Deductions(if any), HRA, E.S.I., and many more. You can also easily extend it by adding your own information as per your company’s employee policy. Since this salary template is created using MS Word so it is very easy to edit or customize it per any situation possible. You just need to have MS Word installed on your PC before you can plan to start editing this slip template.

Free Salary Slip Templates

Here are the previews of our Salary Slip Templates created using MS Word.

Here is the download button for this Salary Slip Template.

The download button for this template is here.

Here is the download button for this template.

The download button for this pay slip template is here.

Here is the download button for this Salary Slip Template created using MS Word.

Salary slips are short but very important documents since these are the record of the salary of any employee which hold the details of all the payments which are done to the employee. It also has information on all the applicable taxes and charges to the employee and also all the paid allowances, basic pay, and other bonuses. Pay slips need to be taken care of and kept a record of to keep a check of the payment history and make any corrections if there happen to be any with the accounts department.

Salary Slip Templates Guidelines

Pay slips are designed by the accounts department people in any governmental institution, a private company, or any other business firm. Even small businesses do have salary slips, either designed by them or paid to a design by someone expert in this field. However, anyone can design their own custom salary slips for their employees. We are giving a few important tips if you plan to design your very own salary slips for your company employees. Here are a few:

- Make sure the pay slips are not very long. The size of salary slips should be small enough to make one tissue paper-sized fold and kept in a shirt pocket.

- The paper does not have to be very fine quality, since the employees are going to throw it away at the end of the year (some of them even throw after they get their salary). Nowadays salary slips are also created and sent in electronic form i.e. computer software generated documents in some advanced companies, so that takes out the paper quality case.

- The salary slip will be bearing the company name or the name of the governmental institution where the employee is currently employed.

- If there happens to be any sub-department, mention it following the above detail.

- Afterward, leave spaces for employee particulars which will include name, designation, and employee number in some cases.

- The current time period of salary which is the month and the year will come after the employee details.

- Now comes the most important part; the payment details. Usually, two sections are made which comprise employees’ take-home pay and his/her deductions in form of funds and taxes, etc. Mention all that are applicable in relative fields of this section of the salary slip.

- Finally, the take-home salary will be printed or written at the end of the salary slip so leave two respective sections for the amount in words and digits at the end.

- A place for dates and signatures of authorities, as well as employees, should be left at the lower end of salary slips.