When a lender and borrower enter into a deal that involves money/a loan, interest, and repayment of the loan, there are always some chances and possibilities that one of them might not stick to the rules and conditions as provided and agreed upon by both of them. In order to secure the rights and protect their assets, the lender or the financial firm requires some kind of security from the borrower, which is most likely a real estate property that the bank pledges, or in simple words, keeps as security for the safe return of the loan from the borrower. The agreement that is signed by the lender and borrower to pledge the property is known as the security agreement.

Brief Description of Security Agreement:

Most companies and individuals prefer not to get any kind of loan until they need it the most and there is no other option. When this happens, there are dozens of financial firms and banks in each country and city that help the companies and individuals with their financial helps with granting loans. The person or bank that gives the loan is known as the lender or creditor and the person or company that takes the loan is known as the borrower or debtor. When a company or business agrees to get the loan, they also agree to return it in small installments with a specific rate of interest. It is very important to understand that no matter how willing the company or individual is to pay back the debt, the bank or financial firms don’t put their resources in jeopardy and take essential steps to make sure that the debt will be returned.

In most cases, a guarantor is required to get the loan from a bank but some banks and financial firms also pledge real estate property as the security for the safe return of the debt. This means that if you want to get a loan, you have to put your property in a pledge with the bank so that if you can’t give back the loan, the bank will auction the property and clear their debt where on the other hand, if you safely return the debt, the property will be returned to you with full rights and ownership. The security agreement is the legal document that is signed between the bank and the debtor that includes the details of the property and permission from the owner to pledge the property with the bank.

Ready-to-Use Security Agreement Format (Sample + Blank Form)

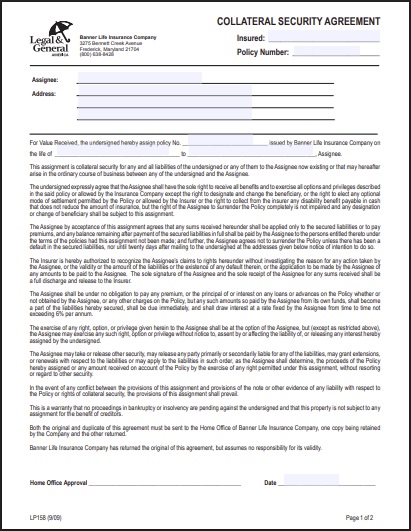

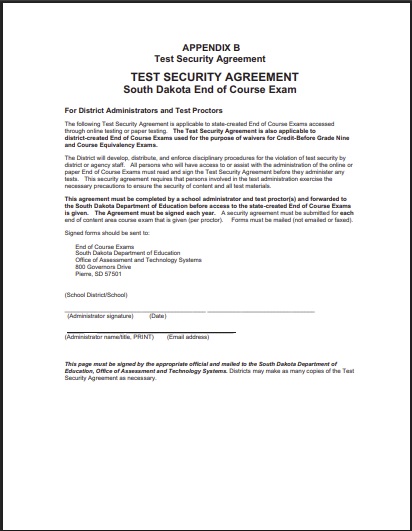

Collateral Security Agreement

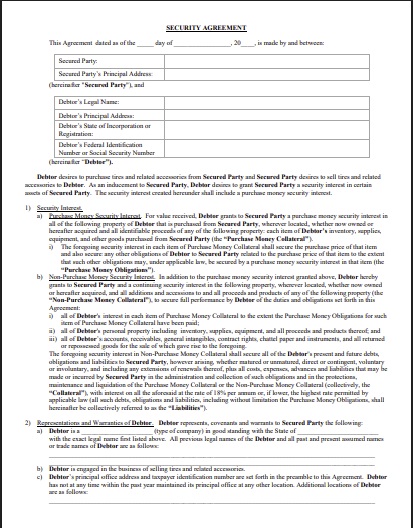

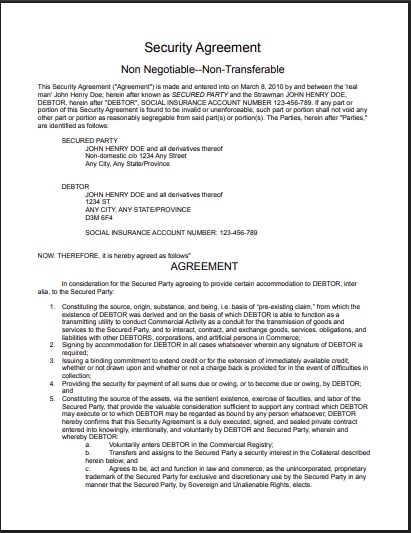

Legal Security Agreement Document

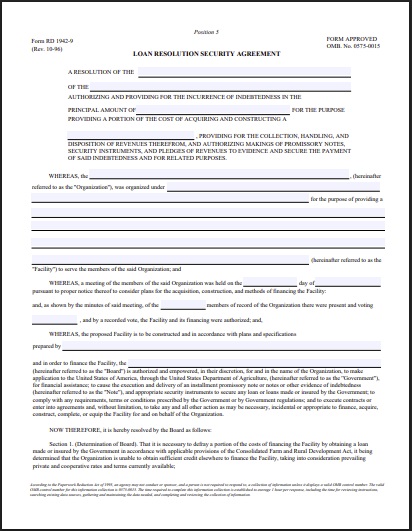

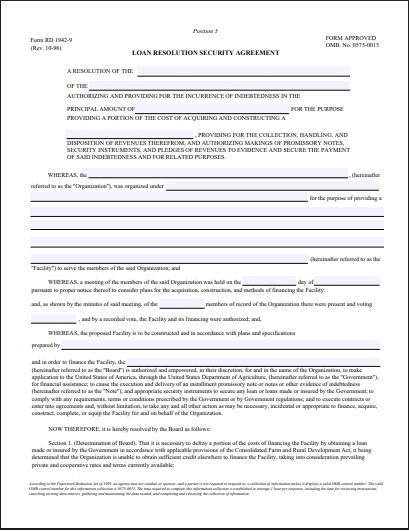

Loan Resolution Security Agreement Example

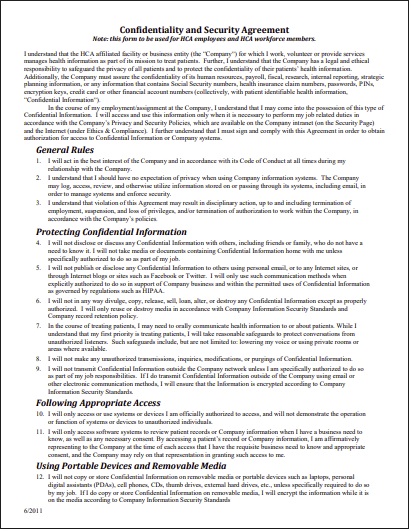

Secured Transaction Agreement

Security Agreement Contract Sample

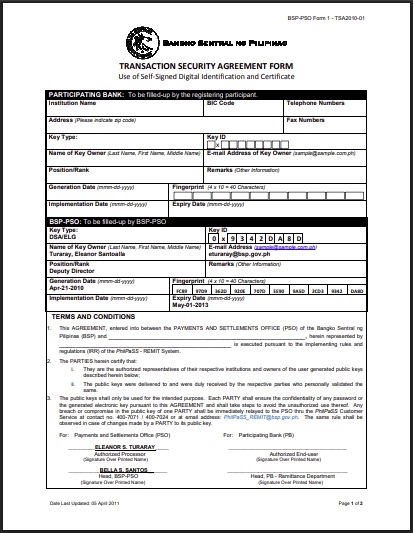

Transaction Security Agreement Form

Security Agreement PDF Download

Vehicle Security Agreement Form

Editable Security Agreement Word

Security Agreement Format

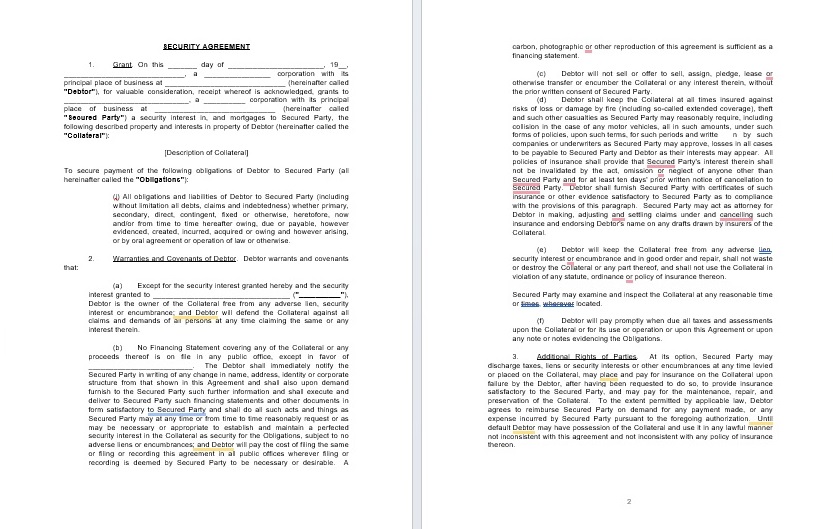

Here is below we shared a comprehensive format of security agreement. You can fill it as according to your requirements.

This Security Agreement (“Agreement”) is made and entered into on this ___ day of _______, 20, by and between:

Lender (Secured Party): __________________________________________

Address: _________________________________________________________

Phone: ___________________________ Email: __________________________

Borrower (Debtor): _____________________________________________

Address: _________________________________________________________

Phone: ___________________________ Email: __________________________

1. Description of Collateral

The Borrower grants the Lender a security interest in the following collateral as security for the repayment of the loan:

(Include details such as vehicle, equipment, property, or other assets.)

2. Loan Details

Principal Amount: $_________________

Interest Rate: ___________% per annum

Loan Term: _________________________

Payment Schedule: __________________

3. Security Interest

The Borrower agrees that the Lender holds a security interest in the collateral until the total amount due is fully paid. The Lender may take possession of the collateral upon default.

4. Default

In the event of default, the Lender may exercise any legal rights, including repossession or sale of the collateral, in accordance with applicable laws.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State/Province of ______________________.

6. Entire Agreement

This Agreement represents the entire understanding between the parties and supersedes all prior negotiations or agreements.

7. Signatures

Lender (Secured Party):

Signature: ___________________________

Printed Name: ________________________

Date: _______________________________

Borrower (Debtor):

Signature: ___________________________

Printed Name: ________________________

Date: _______________________________

Witness (Optional):

Signature: ___________________________

Printed Name: ________________________

Date: _______________________________

Key Elements to add to the Security Agreement:

- Name of the lender/financial firm/bank

- Name of the borrower/debtor/individual or company

- Details of the loan with interest rates

- Duration in which the borrower will return the loan

- Details of installments or periodic payments of the loan

- Details of the property given to the lender as security of the loan

- Rights of the lender on the property in case of default debt

- Responsibilities and rights of each party

- Terms and conditions of the agreement

- Mutually agreed clauses of the agreement

- Termination of the agreement

- Results of violation of the agreement

- Validation and limitations of the agreement

- Signature of both parties with witnesses